Fuse Public Liquidity Release on Mesa Decentralized Exchange

We are excited to announce the first public liquidity release of Fuse network’s native token!

Distribution Summary

Start Date: 15:00 GMT — Thursday 22nd October 2020

End Date: 15:00 GMT — Saturday 24th October 2020

Ticker: FUSE

Total Initial Supply: 300,000,000

Initial Sale Supply: 10,000,000

Token Purchase Pair: FUSE/USDC

Start Price: USD $0.06

Minimum Allocation: $2,500

Tokens will be distributed using a Bonding Curve Distribution on Mesa. More information on this is provided below.

Overview

Releasing liquidity to the public is an essential step towards distributing ownership and network decision making away from a central authority to the Fuse community through delegation and staking.

Fuse is hyper-focused on building real-world products that impact the lives of everyday people. It was, therefore, important for us to wait until we had a working product, live implementations, and an engaged community of core believers before releasing liquidity.

Over 300 micro-economies in 30 countries have been launched on Fuse, using our easy to use interface. From Wikibank which provides donations to impoverished communities in Seville to PayWise which provides access to mobile payments in the largely unbanked population of Trinidad & Tobago, real-world individuals are being helped using Fuse. Another important project, GoodDollar also allows UBI (Universal Basic Income) for thousands of users powered by the Fuse Blockchain.

Now it’s time for the community to participate!

Network Traction

Fuse is a DPoS blockchain with EVM compatibility and a bridge to Ethereum, on a mission to bring a new wave of adoption to crypto through a global network of small, thriving economies! Our solution dramatically lowers operational costs and entry barriers for communities that wish to build payment ecosystems designed to incentivize participation and unlock economic growth. Learn about the Fuse token (FUSE) economics here in our Tokenomics document and track live network statistics on the Fuse Explorer.

What is Mesa and Bonding curve distribution?

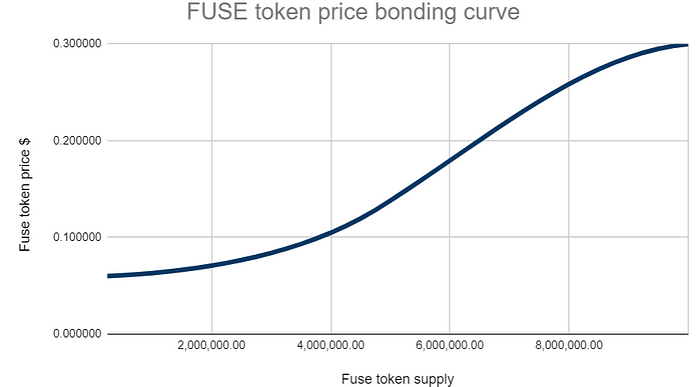

A bonding curve distribution is an innovative way to price and allocate tokens. The bonding curve is a predefined price curve. The price for each token incrementally increases as more tokens are bought, and decreases as they are sold back. A bonding curve serves the determination of the price equilibrium. Bonding curves have mostly been implemented on decentralized exchanges and their popularity has recently experienced significant growth.

Early attempts at using decentralized exchanges and bonding curves for new token distributions have not fulfilled their full potential as decentralized exchanges usually offer a one-size-fits-all curve for trading tokens. So we searched for a more customizable solution for growing ecosystems like ours. This led us to Mesa, which allows for great flexibility & functionality:

- No frontrunning — In traditional decentralized exchanges (DEX’s) there is a massive problem with algorithmic traders and bots frontrunning users. Mesa is built to prevent this by creating predetermined batches of tokens. This allows users to participate in the price discovery phase without the risk of “middle-men” taking a profit because of their slow transaction speed.

- Fair market value determined by the community — A bonding curve with a predetermined price structure from the foundation is matched with an open order book from users.

- Decentralized — The Mesa exchange is run by DXdao which has a very transparent and robust community of operators. The order book and trade settlement is done on-chain which makes it fully transparent and independent of any single operator.

Users can submit orders that are then picked up by “Solvers” that settle the trades. Instead of settling orders exactly at their limit price, on Mesa, solvers determine prices by computing the intersection of the supply and demand curves. This means that every order can be settled at its limit price or with a better price, according to supply and demand dynamics at the time of settlement. In the end, each trader with an executed order will have received their accumulation of tokens in such a way that none of the traders gets a worse allocation than another. Tokens are split up until a fair outcome is reached.

How does the Fuse bonding curve work?

Fuse chose a ‘sigmoid bonding curve’ to reward the early adopters and investors who truly care about our DeFi ecosystem, and disincentivize front runners that participate for pure value extractions. Tokens are sold in batches of 5 minutes over the course of 48 hours starting from a price of $0.06 per FUSE.

It is important to note that there is a minimum of $2.5k an order being settled on Mesa as it is not meant for low volume orders. It is recommended to pool orders smaller than $2.5K in order to improve the chances of getting your order passed.

Click here to learn how to participate in the Fuse public release on Mesa

When Uniswap?

Prior to this public liquidity release, Fuse distributed 1 million FUSE tokens to early stakeholders and network participants to contribute, bootstrap, and test the network. This was done in batches of 100K FUSE tokens and amounts to 0.3% of the total token supply.

A Uniswap pool was created with low liquidity. After the closing of the Mesa bonding curve event, the team at Fuse will add liquidity to the Fuse/ETH & FUSE/USDC pools on Uniswap to allow for more robust price discovery and facilitate healthy volumes and usage growth.

FUSE token delegation will be activated by the end of October so that every token holder can lock their FUSE to earn rewards and participate in the governance of the network.

Beware of Scammers:

As always, be careful and double-check everything. We can guarantee that Fuse team members will not PM you first. Do not fall prey to imposters and scammers. Whenever you are in doubt, you are more than welcome to reach out to Fuse admins on the Fuse Telegram channel.

For your reference, the official address of the FUSE token is: https://etherscan.io/token/0x970b9bb2c0444f5e81e9d0efb84c8ccdcdcaf84d

Follow our social media channels to stay updated our recent news and developments at Fuse: