Fee Transparency on Delta Exchange: What Every Crypto Options Trader Should Know

The growth of the crypto market in India is exceptional. Reports show that the crypto industry could reach $9+ billion in revenue by the end of 2025, with active users expected to cross 100 million this year. This growth reflects a clear shift in the sector where trading digital assets is slowly becoming a mainstream financial activity.

For traders exploring opportunities in crypto options, the focus often goes straight to profits, strategies, or which crypto exchange platform offers the most contracts. But there’s another factor that directly affects your trading outcomes — fees.

Every percentage charged on trading BTC or other options can either make or break profits. That’s why fee transparency matters. If you’re looking for the best app for crypto options, Delta Exchange might be a good place to start.

Let’s discuss why Delta Exchange is among the top crypto exchange and how its low fee structure and transparency can help you maximize gains.

Delta Exchange: A Platform Built for New-Age Traders

Among the many choices available today, Delta Exchange stands out as one of the leading names in the crypto derivatives space. Registered with the FIU in India, it has built a reputation for security and reliability — three things that matter when real money is on the line.

Delta Exchange: One of the best apps for crypto options trading in India

The platform offers multiple products, from crypto options and futures to the newly launched trackers, giving you flexibility in your market approach.

Handling over $4.4 billion in daily trading volume, Delta is well-suited for both high-frequency strategies and long-term bets on trading BTC, ETH, and other altcoins. For anyone searching for the best app for crypto options, Delta delivers a balance of transparency, liquidity, and accessibility for all kinds of traders.

What Traders Look for in a Crypto Exchange

Usually, traders have a checklist before choosing a crypto exchange platform, and fees often top that list. Delta Exchange keeps the trading fees for crypto options lower than those of other trading platforms.

Beyond pricing, factors like speed of trade execution, reliable liquidity, INR-based support, and affordable lot sizes also play a big role — and Delta delivers it efficiently.

Whether it’s trading BTC options or exploring other contracts, the best app for crypto options is one that combines fair pricing with dependable performance.

What Fees Do You Actually Pay on Delta?

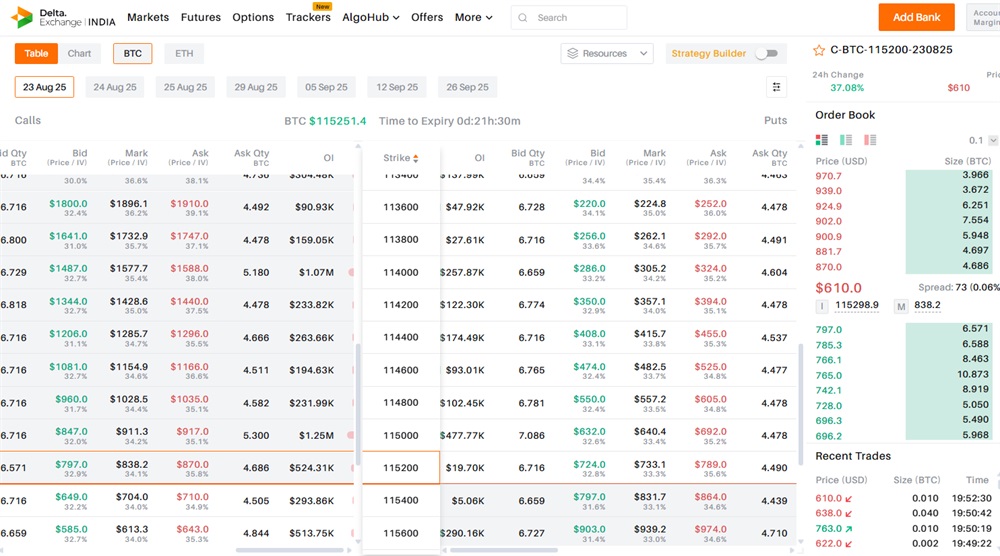

To start crypto options trading on Delta Exchange, visit www.delta.exchange and sign up. Once your account is successfully set up, you can explore the crypto options market.

Crypto options on Delta Exchange: Calls, Puts, Strike price, and more

● On Delta Exchange, options trading fees are set at just 0.015%, with an 18% GST applied on the fee.

● The option fee is capped at 10% of the premium and charges are based on the notional value.

● A settlement fee also applies to open contracts at the time of expiry, calculated at taker rates.

Note: Trading fees are different for futures contracts and trackers.

Features That Add Extra Value

Delta Exchange is an all-in-one platform for those diving into crypto options, especially trading BTC and ETH.

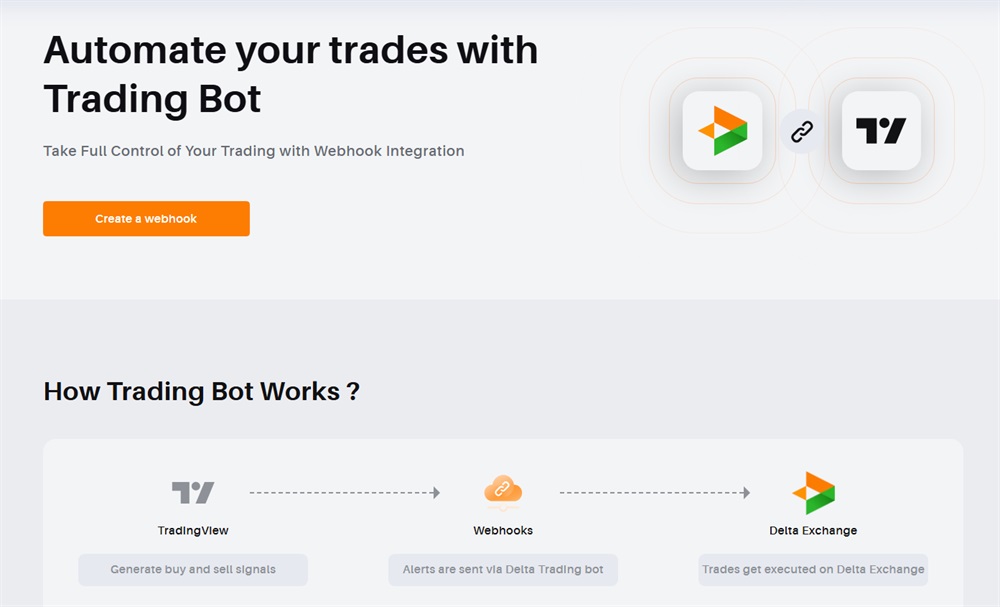

Automated trading bots for enhanced trading

Here’s how the platform adds practicality to your strategies:

1. Payoff charts let you preview how a strategy might perform before placing a trade, giving you clear visuals of potential gains or losses.

2. Demo account offers a risk-free way to try out options, futures, or multi-leg setups without staking real money. This tool is handy for learning or testing ideas before executing trades.

3. Trading bots linked with platforms like TradingView automate trades via webhooks. Your strategies can run 24/7, so you don’t miss opportunities, even away from the screen. You can also integrate Delta APIs and start algo trading.

4. Basket orders let you combine multiple contracts into one smart multi-leg order using a strategy builder. This streamlines execution and can lower your margin needs.

5. 24/7 customer service on Delta Exchange is always present to address your concerns via a ticket-based system. It is helpful if you’re managing positions or navigating fees on a crypto exchange platform.

Keep More of What You Earn

As a trader, you would want to see your hard work and investments grow in actual returns and fees play a major role in this case. A transparent fee structure gives you the confidence that you’re not losing value in places you didn’t expect.

Delta Exchange has been clear in keeping these numbers transparent for all, so you know exactly where your money is going and how you calculate the profits.

If you’re building strategies around crypto options — trading BTC and ETH — this clarity matters just as much as speed, liquidity, or product variety. By pairing fair pricing with other features, Delta creates space for smarter decisions and stronger outcomes.

If you’re comparing choices for the best app for crypto options, think of it this way — the less you spend on hidden costs, the more you keep for yourself. And in crypto trading, saving more profits means winning more.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. Kindly do your own research or consult the experts before making any crypto investments.