What's Mining Pool?

Let's start with a historical and technical reminder. The term mining appeared at the same time as the first blockchain, "the bitcoin blockchain". As Bitcoin is considered to be digital gold, mining refers to the gold miner of the time. Imitating his predecessor, the miner goes out to mine Bitcoin, without his pickaxe but with his computer to solve complex mathematical calculations. Thus, every miner who solves the mathematical calculation is rewarded with Bitcoins.

It should be kept in mind that the probability of creating a block on its own is very low and it is hard to be profitable, it is estimated that a well-equipped independent miner has a 1 in 8,000,000 chance to find the correct mathematical result. However, solutions exist to allow individuals to mine cryptocurrencies, like "mining pools", communities of miners who work together to solve the problems of proof of work (PoW). With a mining pool, your chances increase considerably and you will be paid regularly.

Thus, a mining pool acts as an individual miner, but in reality, it is composed of hundreds of individual miners. Henceforth your success rate increases sharply because you are no longer alone in wanting to solve mathematical calculations. For the distribution of the rewards, the mining pools follow simple logic, the reward is correlated with the quantity of computing power brought to the network.

Ethereum Mining Pool

As for the Bitcoin blockchain, the miners are indispensable, they represent the cornerstone of the network because they dedicate the power of their computers to solve the "proof of work" (the same protocol as Bitcoin), which makes it possible to verify the transactions on the Ethereum Network. Nevertheless, it should be kept in mind that Ethereum will migrate to a Proof of Stake (PoS) protocol from August 2020, which will change many issues, including money supply, mining, and inflation.

Moreover, apart from crypto staking, investors can also earn a passive income on Ethereum by participating in liquidity pools. If you’re wondering how does liquidity pool work, the answer is that users receive a portion of trading fees, in exchange for supplying their tokens to the network in order to provide sufficient liquidity. For many traders, this has been an attractive alternative to staking.

What do I need to start mining Ethereum? Here is a list of essential elements to mine Ethereum:

• A mining rig (You need a mining rig consisting of graphic cards or an ASIC specially designed for Ethereum.)

• A wallet

• A mining software

• And to obtain a better result: a mining pool

How to choose a mining pool? There are many elements to consider, including:

• Hashrate

• Mining fees and payout threshold

• Payment system (there are 4 types of reward distribution PPS, PPS+, PPLNS, and FPPS)

• Depending on the payout system (you will get rewarded constantly or not)

• Convenient statistics

The biggest known pools are based in China, and this might be a threat to the notion of decentralization – Indeed, if most of the hashrate is centralized within one pool, the blockchain’s validation process is at risk – so that’s why we always recommend to spread the hashrate among all the existing mining pools.

Mining activity remains highly concentrated in China. However, there is evidence to suggest that China's grip is loosening in favor of other countries, including the United States. The mining points can be observed with the following map (https://www.cbeci.org/mining_map and https://investoon.com/charts/mining-map/eth). We see more and more European players rising in power and trying to counterbalance Chinese power like Cruxpool, an alternative mining pool.

Beam Mining Pool

Like most cryptocurrencies, Beam relies on miners to add transactions to the blockchain. Beam is a privacy-oriented cryptocurrency, like Monero (XMR) and Zcash (ZEC), is based on a privacy protocol known as Mimblewimble. After a first hard fork in August 2019, the Beam project has just successfully completed its global update on June 28th.

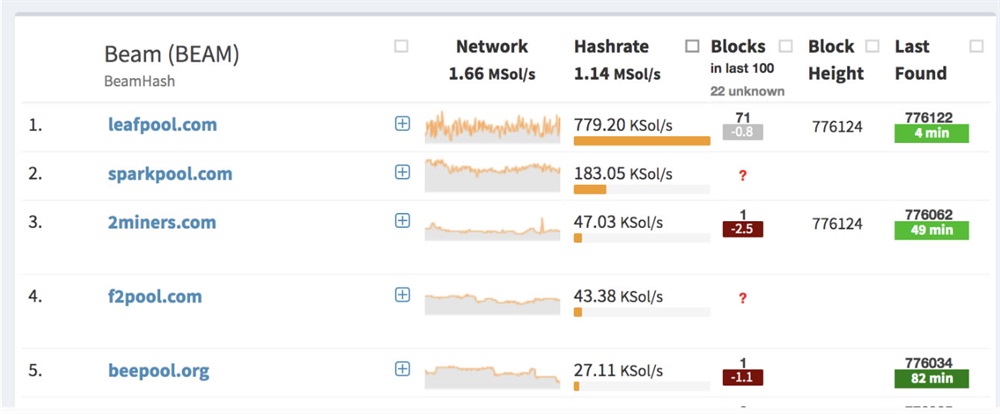

We notice different objectives in this fork, in particular: an improved proof-of-work algorithm, from BeamHash II to BeamHash III, and support for confidential assets. The BeamHash III algorithm is more favorable to GPU miners. Lastly, the following picture shows the most efficient mining-pools:

What is the payout scheme?

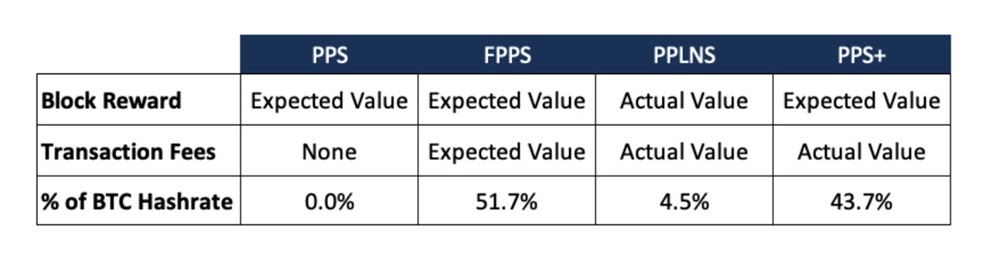

From this point on, there are four major options available to the pool when it receives a share from one of its miners. There are 4 different types of payout, PPS, FPPS / PPS+, PPLNS. I detail here the 4 most known payout.

• PPS: Pay Per Share or commonly known as PPS, each submitted share is worth a certain amount of tokens. Miners are therefore paid based on what is statistically probable at the time of mining rather than what actually happens, this allows the miner to receive a reward no matter what happens. On the other hand, this can be limited, because even if you do a good mining job, the reward will always be the same, it's a lump sum payment. It is risky for the operators in the pool, which is why the fees are the highest.

• FPPS / PPS+: PPS+ is a hybrid of PPS and PPLNS. Similar to Pay Per Share (above), the big difference is that the pool assumes the fee if a block is found.

• PPLNS: Pay Per Last N Share or commonly known as PPLNS is another popular payment method, which offers payment to miners as a % of shares they contribute to the total shares (N). This system rewards minors only when a block has been found by the pool. Therefore, you have to wait until a block is found to receive the reward.

What services does the pool offer?

To fully understand the services and advantages of a mining pool we need to explain all the services. Mining pools deliver solutions and services to those who wish to create a stable income with cryptocurrencies. You simply need to connect to their mining pool (Click-and-Go) and you can simply contemplate your balance increasing at the end of the day (Real-time Statistic). They want to make cryptocurrencies available to everyone and offer many services and advice on mining so as to anybody can connect and start their Journey within the Blockchain.

Therefore, for instance - the aforementioned mining pool Cruxpool offer:

- 1% pool fees

• Real-time stats

• Real-time PPS+

• Professional support

• Instant payout

• Anonymous mining

• Mining Rewards

• Complete tutorials

Conclusion

The mining of cryptocurrencies has undergone a lot of evolution and has become vital to the cryptocurrency ecosystem. It is similar to an arms race (CPU, then GPU then ASICS) with an ever-increasing concentration of mining players in ultra-dominant pools - mostly based in Asia. Thus, even if mining pools do not correspond to Satoshi Nakamoto's original idea of decentralization, mining pools are necessary for the community of miners who could not absorb the risks associated with this activity - if you are a miner, and find no blocks, you are not paid and you continue to pay for electricity and therefore your portfolio decrease in value. Pools allow everyone to support the projects of the different blockchains and also allow many of us to generate a few cryptocurrencies without having to go through cryptocurrency exchanges.