Dai Feed: Events, News & Roadmap

Dai to Be Listed on WEEX

WEEX will list Dai (DAI) on February 4.

Dai to Host Community Call on December 18th

Dai has scheduled a community call on Discord on December 18th at 19:00 UTC.

Sky to Impose 2% MKR-SKY Upgrade Penalty Starting December 15

Sky has announced that a new vote will open on December 11, proposing to raise the Delayed Upgrade Penalty for late MKR-to-SKY conversions from 1% to 2%.

Dai to Host Meetup in Cannes on June 30th

Dai will host an industry gathering in Cannes, on June 30th, bringing together the Sky team, Stars and other participants from the decentralised finance sector.

Dai to Be Delisted From Crypto.com on January 31st

Crypto.com will delist Dai (DAI) on January 31st. The deadline for converting or withdrawing these assets is March 31st.

Dai to Participate in Devcon in Bangkok on November 10th

Dai will be featured at the Devcon conference in Bangkok from November 11th to 13th.

Dai to Host Meetup in Singapore on September 18th

Dai will host a meetup in Singapore on the 18th of September.

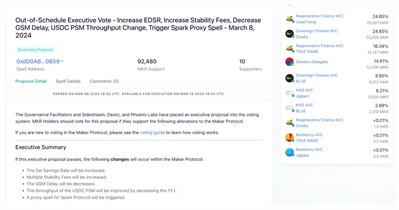

Dai to Release Protocol Update on March 10th

Dai will make several changes in the Maker Protocol. The implementation will be on March 10th at 19:55 UTC.

Dai to Be Listed on BitFlyer on February 19th

BitFlyer will list Dai (DAI) on February 19th.

Dai to Extend Credit Line for Spark on January 14th

Dai has announced a new credit line extension for Spark.

Dai to Be Listed on Bitbank on December 14th

Bitbank will list Dai (DAI) on December 14th.

DAI/BTC Trading Pair to Be Delisted From Bitfinex on November 23rd

Bitfinex will delist DAI/BTC trading pair from Bitfinex on November 23rd.

Dai to Participate in Korea Blockchain Week in Seoul on September 6th

Dai’s co-founder Rune Christensen will be revealing Maker’s Endgame during a panel at Impact, the main event of Korea Blockchain Week.

Dai to Host Meetup in Seoul on September 3rd

Dai is set to embark on the next phase of its evolution with the SubDAO Genesis event.

Dai to Attend WebX 2023 in Tokyo on July 26th

On the second day of the conference, Dai’s cofounder will deliver a talk titled “The Secret to DAO Governance and Growth”.

DAI Peg Parameter Change

Submitted parameter changes are scheduled for deployment in 48 hours, on March 13th at 16:14 UTC.

Listing on CoinTiger

Listing on XT.COM

Listing on BitMart

Staking on Binance

Dai Events on the Chart

What is Dai?

MakerDAO is a key player in the Decentralized Finance (DeFi) sphere, featuring a stablecoin, DAI, which is collateralized by cryptocurrency and pegged to the US dollar. The project is managed by a Decentralized Autonomous Organization (DAO), a governance structure involving token holders in decision-making processes.

The operational mechanism of MakerDAO revolves around the use of Maker Vaults where users lock their cryptocurrency at a specific Liquidation Ratio, enabling them to generate DAI. Overcollateralization is utilized to mitigate risks associated with crypto’s price volatility. If the collateral“s value drops below the Liquidation Ratio, the collateral is liquidated to cover potential losses. Stability of DAI is ensured by the DAO”s regulation of the Stability Fee and DAI Savings Rate, effectively controlling the token’s supply and demand.

As a stablecoin, DAI offers the typical benefits of crypto assets such as worldwide transferability, utility in transactions, and functionality as a hedge against profit and loss fluctuations. Additionally, DAI can be leveraged or invested in a DAI Savings Rate contract for interest. Governance within the MakerDAO ecosystem is facilitated through the use of MKR tokens, allowing holders to participate in decision-making processes ranging from alterations in Stability Fee, DAI Savings Fee, to modifications in the team structure and smart contracts.