Derive to Launch Basis Trade Vault Tokens on March 20th

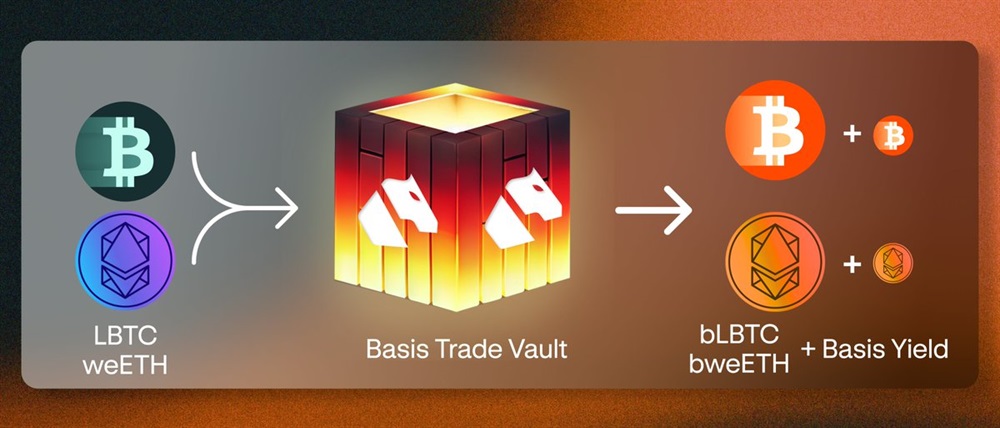

Derive has announced the launch of “b-tokens”, a new type of tokenized assets that automate basis trading. These tokens are designed to increase the yield of BTC and ETH by implementing hedge fund strategies in decentralized finance (DeFi).

Key features:

— Automated trading: b-tokens automate a complex basis trading strategy, allowing users to earn yield without active management.

— Composability: The tokens can be used in various DeFi protocols to further increase yield.

— Yield generation: Yield is generated through perpetual futures funding rates, staking rewards, and restaking points.

— No liquidation risks: The strategy minimizes liquidation risks, making it safer for users.

How it works:

— Users deposit BTC or ETH into a vault.

— The vault borrows USDC against the deposited assets.

— The borrowed USDC is used to buy more BTC or ETH.

— Excess exposure is hedged by shorting perpetual futures.